What is Reevit?

Reevit is a unified payment orchestration platform designed specifically for the unique challenges of African commerce. We provide a single API that connects you to every major payment provider across the continent, automating the complexity of routing, failover, and reconciliation.🚀 The Value Proposition

We built Reevit to serve two distinct needs: growing your business and simplifying your engineering.🏢 For Business Leaders

- Revenue Rescue: Stop losing sales when a provider goes down. Reevit automatically fails over to a backup provider in real-time.

- Global Reach, Local Feel: Accept Mobile Money (M-Pesa, MoMo), Bank Transfers, and Cards across 5+ countries with one contract.

- Direct Ownership (BYOK): Use your own PSP keys. You keep your direct relationships with providers like Paystack or Stripe while we handle the technical orchestration.

- Operational Clarity: Unified analytics across all providers. No more logging into five different dashboards to see your daily sales.

💻 For Developers

- One API, Infinite Providers: Write code once. Our standardized API abstracts away the quirks, different response formats, and error codes of 10+ PSPs.

- Unified Webhooks: Receive normalized event notifications. Whether it’s a card payment from Nigeria or M-Pesa from Kenya, the payload format stays the same.

- SDK-First Experience: Fully typed SDKs in TypeScript, Python, Go, and PHP. Integration takes minutes, not weeks.

- Built-in Reliability: Automatic retries, signature verification, and idempotency are handled at the platform level.

🛠️ How It Works

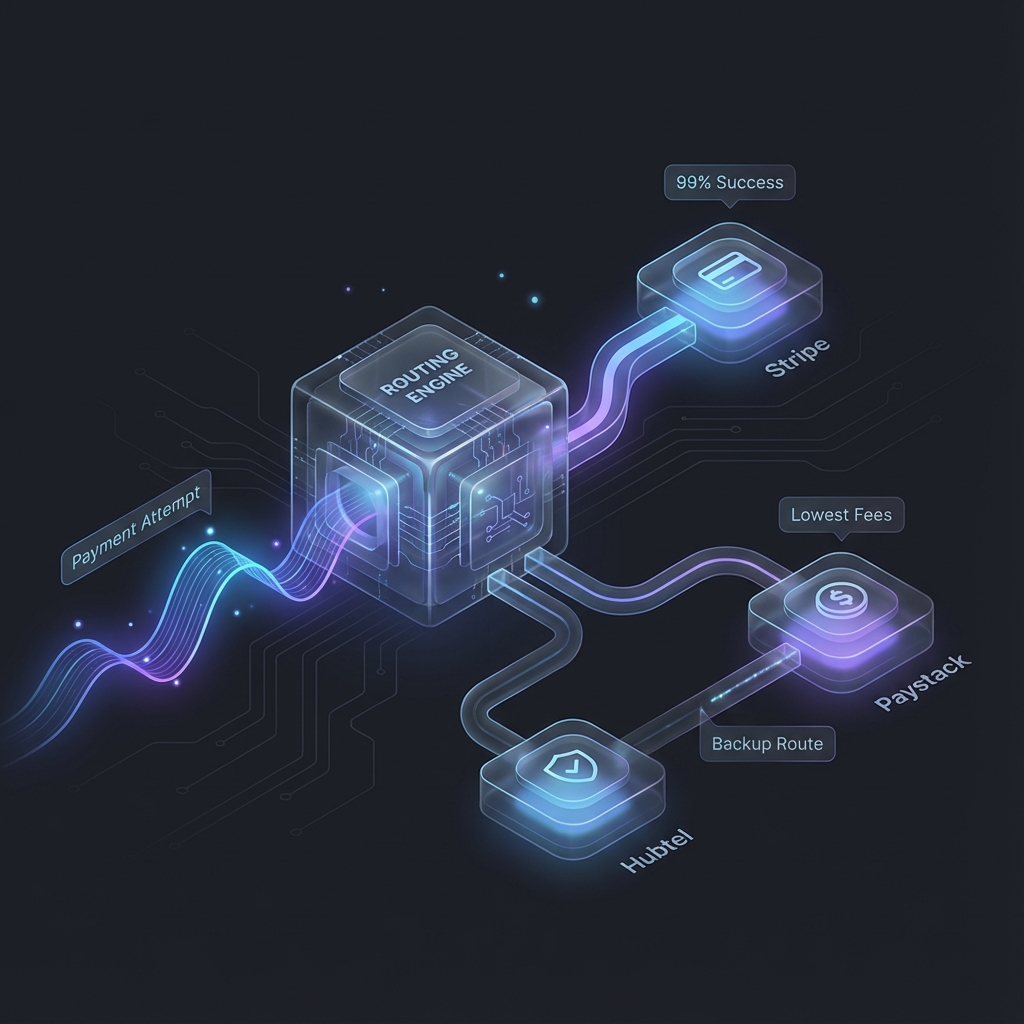

Reevit sits between your application and your payment providers, acting as an intelligent conductor for every transaction.

- Unified Request: Your application sends a single payment intent to Reevit.

- Orchestration Engine: Reevit evaluates your Routing Rules and provider health.

- Smart Routing: The transaction is routed to the optimal provider (based on success rates or fees).

- Automatic Failover: If the primary provider is down, Reevit instantly tries a fallback connection.

- Verified Webhook: You receive a single, verified notification once the payment is final.

🌍 Supported Ecosystem

We’ve integrated the providers that matter most for African business:| Region | Primary Providers | Payment Methods |

|---|---|---|

| West Africa | Paystack, Hubtel, Flutterwave, Monnify | Cards, Mobile Money, Bank Account |

| East Africa | M-Pesa, Flutterwave | MPESA, Cards |

| Global | Stripe | Credit/Debit Cards, Apple Pay, Google Pay |

🏗️ Core Pillars

Connections

Manage your provider credentials in one place with our Bring Your Own Key (BYOK) model.

Workflows

Automate post-payment actions like sending receipts, Slack alerts, or updating your CRM.

Smart Routing

Maximize success rates and minimize fees with priority-based routing logic.

Webhooks

Standardized, secure event delivery for real-time application updates.